take note2

Saturday, February 25, 2023

餐馆高薪招聘引热议 洗碗工服务生月薪3250元

Tuesday, January 31, 2023

SG room rental sky high?

4-Room HDB Flat Rented Out at a Record Price of $6,200 a Month

A four-room HDB flat in Tiong Bahru just broke the record for the highest rental price monthly, with a price tag of $6,200 a month. It was an older flat of about 1,200 square feet at Block 17 Seng Poh Road, with less than a 50-year lease remaining.

Additionally, there are at least three other four-room flats with a monthly rent of over $6,000. Two are in Pinnacle @ Duxton, while the other is in the Whampoa area at Jalan Tenteram.

Unfortunately, this exorbitant rental price isn’t an outlier but a reflection of rising price trends. Four-room HDB flats with monthly rents of over $4,000 have doubled in the past two months, at 223 units. This applied to all areas islandwide, not just your typical atas neighbourhoods.

Shin Min Daily News reveals the top four reasons why HDB rentals are increasing in price, according to industry experts.

Fewer Flats Meeting Minimum Occupancy Period in 2023

The new batch of five-year minimum occupancy period flats will drop sharply this year, from 31,000 to 15,700.

This means that fewer units will be released for buyers, and renting will continue to dominate the housing market.

Constant Demand from Everyone

With the influx of foreign employees and students after our borders reopened after the pandemic, there has been an increase in demand for housing.

Additionally, there has been a shortage of university and employee dormitories, alongside an increase in young couples renting houses while waiting for their BTO to be ready.

With such high demand from all types of renters, rental prices are expected to continue to rise.

It may be even worse for specific areas like Toa Payoh, which saw an increase from four to 21 flats that crossed the $4,000 rental price mark in 2023. Similar areas with many schools, industrial areas and office buildings nearby may experience a similar spike in rental prices.

Soaring Private Apartment Rental Prices

According to data from real estate websites and the Singapore Real Estate Exchange (SRX) for November 2022, the price of private housing rent rose by 34%. This is higher than the 27.8% increase for HDB rent.

Thus, people who originally wanted to rent private housing may end up switching to HDB rentals, which are more budget-friendly.

Rising Bank Interest Rates

Last but not least, bank interest rates have also been on the rise.

Landlords who borrowed from banks to finance the houses may thus face higher interest rates and pass it on to their renters via higher rental prices.

Info from the web

Thursday, June 30, 2022

GST how much we can get ?

TL;DR: GST Voucher 2022 & Budget 2022 Household Support Package (HSP) + Assurance Package (AP) Guide

For Budget 2022, the Ministry of Finance (MOF) announced three support schemes to help lower to middle-income Singaporean households cope with the impending GST increase in 2023 and 2024.

They are the following:

- Enhanced Permanent GST Voucher (GSTV) Scheme

- Household Support Package (HSP) — Transitory

- Assurance Package (AP) — Transitory.

New $1.5 Billion Support Package 2022 (June)

In addition, the Government announced a new $1.5 billion support package in June to help the lower-income groups cope with worldwide inflation and the rising cost of living in Singapore.

Eligible Singaporeans will receive a one-off $300 Special GST voucher in August 2022 and all Singaporean households will receive $100 worth of utility credits in September 2022.

GST Voucher 2022 Payout Date

Here is an overview of how much Government support each scheme provides, how much you may get as well as the GST Voucher 2022 payout dates:

| Permenant GST Voucher Scheme | |||

|---|---|---|---|

| GST Voucher (GSTV) Component | How Much Will I Get? | Who Is Eligible? | When Is The Payout Happening? |

| Enhanced GSTV – Cash | $250 - $400 | Singaporeans: -Aged 21 and above -Annual Income (AI): ≤$34,000 -Annual Value (AV) of home: $13,000 - $21,000 | Aug 2022 |

| GSTV - Cash Special Payment | Up to $300 | Singaporeans: -Aged 21 and above -Annual Income (AI): ≤$34,000 -Annual Value (AV) of home: ≤$21,000 | Aug 2022 |

| GSTV – MediSave | $150 - $450 | Aged 65 and above Residential address is a property that does not exceed an AV of $21,000 Do not own more than one property | 2022 (T.B.C.) |

| GSTV - U-Save + HSP U-Save + AP U-Save | $440 - $760 | Eligible Singaporean households with at least one Singaporean as the owner, occupier, or tenant of the HDB flat Household members cannot own more than one property | Apr 2022 Jul 2022 Oct 2022 Jan 2023 |

| GSTV Service & Conservancy Charge (S&CC) Rebates | 1.5 - 3.5 months | Singaporean households living in HDB Household members cannot own more than one property + rented out the whole flat | Apr 2022 Jul 2022 Oct 2022 Jan 2023 |

| Household Support Package (HSP) Scheme | |||

| HSP Component | How Much Will I Get? | Who Is Eligible? | When Is The Payout Happening? |

| HSP CDA, Edusave, PSEA Account Top-ups | $200 | Singaporean children aged 0 - 20 in 2022 | Sep 2022 (CDA) May 2022 (Edusave + PSEA) |

| HSP Community Development Council (CDC) Vouchers | $100 | All Singaporean households | 2022 (T.B.C.) |

| Assurance Package (AP) Scheme | |||

| AP Component | How Much Will I Get? | Who Is Eligible? | When Is The Payout Happening? |

| AP Cash Payouts | $100 - $200 in 2022 ($700 - $1,600 over 5 years) | Adult Singaporeans aged >21 Owns 0 to 1 property | Dec 2022 first payout (2022 - 2025) |

| AP GST Voucher – Cash (Seniors’ Bonus) | $200 - $300 in 2023 ($600 - $900 over 3 years) | Elderly Singaporeans aged >55 | 2023 - 2025 |

| AP MediSave Top-ups | $150 in 2023 ($450 over 3 years) | Singaporeans aged 20 years and below + 55 years and above | 2023 - 2025 |

| AP CDC Vouchers | $400 ($200X2) | All Singaporean households | 2023 & 2024 |

| New $1.5 Billion Support Package | |||

| New $1.5 Billion Support Package Component | How Much Will I Get? | Who Is Eligible? | When Is The Payout Happening? |

| Utilities Credit (One-off) | $100 | All Singaporean households | Sep 2022 |

Click to Teleport

- What Is The Enhanced Permanent GST Voucher Scheme (2022)?

- Enhanced GST Voucher – Cash

- $300 Special Gst Voucher – Cash: New $1.5 Billion Support Package Announced in June 2022

- GST Voucher – MediSave

- GST Voucher – U-Save 2022 (Utility Rebates)

- GST Voucher – Service and Conservancy Charges (S&CC) Rebate

- Household Support Package (HSP): Utility Rebates

- Household Support Package (HSP): Top-ups to Child Development Account (CDA), Edusave Account, and Post-Secondary Education Account (PSEA)

- Household Support Package (HSP): $100 Community Development Council (CDC) Vouchers

- Budget 2022 Singapore Cash Payout Date: Assurance Package (AP) For GST

- Assurance Package (AP): GST Voucher – Cash (Seniors’ Bonus)

- Budget 2022 Assurance Package (AP): Utility Rebates

- Assurance Package (AP): MediSave Top-ups

- Assurance Package (AP): CDC Vouchers 2022

What Is the GST Voucher Scheme (2022)?

The permanent GSTV scheme was first introduced in Budget 2012 to help lower, and middle-income Singaporeans cope with GST hikes.

For Budget 2022, this scheme was enhanced.

Most notably, the GSTV – Cash was improved, and the Service and Conservancy Charges (S&CC) rebate became a permanent fixture of the GSTV scheme, on top of the GSTV – Cash, MediSave, and U-Save components.

The enhanced GSTV scheme will cost the Government $1.2 billion in Financial Year (FY) 2022.

As long as you’re eligible, you can expect to collect four different GSTV components throughout the year:

- GSTV – Cash

- GSTV – MediSave

- GSTV – U-Save

- GSTV – Service and Conservancy Charges (S&CC) Rebate.

Enhanced GST Voucher – Cash 2022

First up, we have the GST Voucher — Cash component. As announced in Budget 2022, this component will be enhanced.

Who is Eligible for GST Voucher?

Let’s look into how it has been changed.

Previous GST Voucher Eligibility 2022

Back in February 2022, all Singaporeans who meet the following criteria can receive the GSTV – Cash component benefits:

- Aged 21 years and above

- With an annual income (AI) of not more than $28,000

- Whose residential address is a property that does not exceed an Annual Value (AV) of $21,000

- Those who do not own more than one property.

Enhanced GST Voucher Eligibility 2022

But for 2022 and beyond, the AI cap will be raised from $28,000 to $34,000. This means that more Singaporeans or 1.5 million adult Singaporeans will receive the enhanced GSTV Cash for the payout in August 2022.

Here are the updated criteria for the Enhanced GSTV – Cash:

- Aged 21 years and above

- With an annual income (AI) of not more than $34,000

- Whose residential address is a property that does not exceed an Annual Value (AV) of $21,000

- Those who do not own more than one property.

Enhanced GST Voucher Amount and Timeline

| Singaporeans Aged 21 & Above With Annual Income (AI) <$34,000 | Annual Value (AV) of Home | |

|---|---|---|

| AV ≤ $13,000 | $13,000 < AV ≤ $21,000 | |

| Previous GSTV – Cash | $300 | $150 |

| Enhanced GSTV – Cash in 2022 | $400 (+$100) | $250 (+$100) |

| GSTV – Cash in 2023 onwards | $500 (+$100) | $250 |

| Notes: (1) Individuals who own more than one property are not eligible for GSTV – Cash (2) For 2022 GSTV – Cash, the AI for Year of Assessment (YA) 2021 will be considered to determine an individual’s eligibility (3) For 2023 GSTV – Cash, the AI for YA2022 will be considered | ||

Source: MOF

As seen in the table above, the GSTV – Cash payout amount will also be increased by up to $500, in two steps:

- (1) 2022: All GSTV-Cash recipients will receive $100 more than current rates.

- (2) 2023: Those residing in homes with an AV of $13,000 and below will receive a further $100 enhancement to their payouts.

$300 Special Gst Voucher – Cash: New $1.5 Billion Support Package 2022 (June)

In June 2022, it was announced that 1.5 million eligible Singaporeans will receive a special GST Voucher payment of up to $300 in August 2022.

These are the criteria for receiving this voucher:

- Aged 21 years and above

- With an annual income (AI) of not more than $34,000

- Whose residential address is a property that does not exceed an Annual Value (AV) of $21,000

- Those who do not own more than one property.

This is in addition to the Enhanced GSTV – Cash mentioned during Budget 2022.

In total, with the previously announced Enhanced GSTV-Cash during Budget 2022, all eligible Singaporeans can get up to $700 in August 2022.

When is the Payout Happening for GST Voucher – Cash and GSTV Special Payment (2022)?

If you want to make sure that you get your money ASAP, you’ll need to set up your PayNow and get it linked to your NRIC.

If you don’t have PayNow or haven’t linked it to your NRIC, it’ll be directly credited to your DBS/POSB, OCBC or UOB bank account.

And if you’re living off-the-grid for whatever reason, please check your mail for a cheque which you’ll need to bank in within six months.

Or it’ll all go into your Central Provident Fund (CPF) Ordinary Account (CPF OA) instead.

GST Voucher – MediSave 2022

Next up, we have the GSTV – MediSave component, which benefits elderly Singaporeans.

GST Voucher – MediSave Eligibility

All elderly Singaporeans who meet the following criteria will receive the GSTV – MediSave top-up:

- Are aged 65 and above

- Whose residential address is a property that does not exceed an AV of $21,000

- Do not own more than one property.

GST Voucher – MediSave Amount and Timeline

| Age of Singaporean in 2022 | AV of Home | |

|---|---|---|

| AV ≤ $13,000 | $13,000 < AV ≤ $21,000 | |

| 65 to 74 | $250 | $150 |

| 75 to 84 | $350 | $250 |

| 85 and above | $450 | $350 |

| Note: Individuals who own more than one property are not eligible for GSTV – MediSave. | ||

Source: MOF

GST Voucher – U-Save 2022 (Utilities Rebate 2022)

Next up, we have the GSTV – U-Save component.

This component will benefit the 950,000 Singaporean households that stay in Housing and Development Board (HDB) flats.

GST Voucher – U-Save Eligibility

But, these Singaporean households need to meet the following criteria:

- Households must have at least one Singaporean as the owner, occupier, or tenant of the HDB flat

- Household members cannot own more than one property.

If you’re wondering what U-Save credits can be used for, you can use them to offset your costly utility bills (looks at SP group).

And if your U-Save rebate is higher than your actual utility bill for the month, the unused portion will be rolled over to next month’s bill.

Btw, you don’t have to do anything or register for this payout.

If you qualify, you’ll automatically receive the U-Save rebates on your utility bills.

GST Voucher – U-Save 2022 Amount + Additional Rebates Under Budget 2022 Household Support Package (HSP) & Assurance Package (AP)

As announced at Budget 2022, eligible Singaporean households will receive added GSTV – U-Save rebates under the $560 million Household Support Package (HSP) in April 2022, July 2022, and October 2022, and the $6.64 billion Assurance Package (AP) for GST from January 2023 until January 2026.

| HDB Flat Type | April 2022 | July 2022 | October 2022 | January 2023 | Total GSTV U-Save for FY2022 | ||||

|---|---|---|---|---|---|---|---|---|---|

| Regular U-Save | HSP U-Save | Regular U-Save | HSP U-Save | Regular U-Save | HSP U-Save | Regular U-Save | AP U-Save | ||

| 1- and 2-Room | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $760 |

| 3-Room | $85 | $85 | $85 | $85 | $85 | $85 | $85 | $85 | $680 |

| 4-Room | $75 | $75 | $75 | $75 | $75 | $75 | $75 | $75 | $600 |

| 5-Room | $65 | $65 | $65 | $65 | $65 | $65 | $65 | $65 | $520 |

| Executive / Multi-Generation | $55 | $55 | $55 | $55 | $55 | $55 | $55 | $55 | $440 |

| Notes: (1) Households whose members own more than one property are not eligible for GSTV – U-Save. (2) Additional rebates will be credited to eligible households at the same time as their regular GSTV – U-Save in the usual four quarters (April 2022, July 2022, October 2022, and January 2023). (3) The AP U-Save will be provided quarterly starting from January 2023 and ending in January 2026. | |||||||||

All Households To Receive A $100 Utilities Credit To Offset Bills (New $1.5 Billion Support Package Announced in June 2022)

In addition as part of the new $1.5 billion support package announced in 2022, all Singaporean households will receive $100 worth of utility credits.

And by all Singaporean households, I mean all as even those who are staying in private properties will receive this $100 utilities credit.

The utility credit will help you offset your utility bills and it will be disbursed by September 2022.

GST Voucher – Service and Conservancy Charges (S&CC) Rebate 2022

As announced at this year’s budget, the S&CC rebate will become a permanent fixture of the GSTV scheme from FY2022.

This component benefits about 950,000 eligible Singaporean households that stay in Housing and Development Board (HDB) flats every year.

These households will receive between 1.5 to 3.5 months of S&CC rebates in FY2022.

GSTV S&CC Rebates Eligibility

But, these Singaporean households need to meet the following criteria:

- Households must have at least one Singaporean as the owner, occupier, or tenant of the HDB flat

- Households with a member owning or having any interest in a private property, or have rented out the entire flat, are not eligible for the S&CC rebate.

GSTV S&CC Rebates Amount and Timeline

| HDB Flat Type | No. of Months of S&CC Rebate in FY2022 | ||||

|---|---|---|---|---|---|

| April 2022 | July 2022 | October 2022 | January 2023 | Total for FY2022 | |

| 1- and 2-room | 1 | 1 | 1 | 0.5 | 3.5 |

| 3- and 4-room | 1 | 0.5 | 0.5 | 0.5 | 2.5 |

| 5-room | 0.5 | 0.5 | 0.5 | 0.5 | 2 |

| Executive / Multi-Generation | 0.5 | 0.5 | 0.5 | - | 1.5 |

| Notes: (1) Eligible households will receive their S&CC Rebate in April 2022, July 2022, October 2022, and January 2023. (2) Households with a member owning or having any interest in a private property, or have rented out the entire flat, are not eligible for the S&CC Rebate. | |||||

Understanding Service and Conservancy Charges (S&CC)

If you’re looking at the number of months of S&CC rebates you’re eligible for and are going, “Chey… 3.5 months only. Like nothing really much, leh…”

WRONG.

Let’s say you were living in a one-room flat in Toa Payoh-Bishan and your S&CC charges are about $702 ($58.50X12) a year.

With the rebates, you would save $204.75 ($58.75X3.5) a year!

Budget 2022: Household Support Package (HSP)

In addition to the Permanent GSTV Scheme, the Government has rolled out the transitory $560 million HSP, which will help Singaporean families to cope with the rising cost of living.

The HSP will help Singaporean families to meet their daily needs through:

- Utility rebates

- Top-ups for children’s education

- Vouchers for use at heartland shops.

Household Support Package (HSP): Utility Rebates

As mentioned above, households will receive Additional GST Voucher — U-Save rebates as part of the HSP.

| HDB Flat Type | April 2022 | July 2022 | October 2022 | January 2023 | Total GSTV U-Save for FY2022 | ||||

|---|---|---|---|---|---|---|---|---|---|

| Regular U-Save | HSP U-Save | Regular U-Save | HSP U-Save | Regular U-Save | HSP U-Save | Regular U-Save | AP U-Save | ||

| 1- and 2-Room | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $760 |

| 3-Room | $85 | $85 | $85 | $85 | $85 | $85 | $85 | $85 | $680 |

| 4-Room | $75 | $75 | $75 | $75 | $75 | $75 | $75 | $75 | $600 |

| 5-Room | $65 | $65 | $65 | $65 | $65 | $65 | $65 | $65 | $520 |

| Executive / Multi-Generation | $55 | $55 | $55 | $55 | $55 | $55 | $55 | $55 | $440 |

| Notes: (1) Households whose members own more than one property are not eligible for GSTV – U-Save. (2) Additional rebates will be credited to eligible households at the same time as their regular GSTV – U-Save in the usual four quarters (April 2022, July 2022, October 2022, and January 2023). (3) The AP U-Save will be provided quarterly starting from January 2023 and ending in January 2026. | |||||||||

Household Support Package (HSP): Top-ups to Child Development Account (CDA), Edusave Account, and Post-Secondary Education Account (PSEA)

As part of the HSP, the Government will help families with their children’s education-related expenses.

The Government will provide a $200 top-up for about 790,000 children aged 0 – 20 years old as follows:

| Age in 2022 | Date of Birth (Inclusive of Both Dates) | Account Receiving Top-up | Amount | Estimated Timeline |

|---|---|---|---|---|

| 0 – 6 | Between 1 Jan 2016 & 31 Dec 2022 | CDA | $200 | From Sep 2022 |

| 7 – 16 | Between 1 Jan 2006 & 31 Dec 2015 | Edusave | $200 | May 2022 |

| 17 - 20 | Between 1 Jan 2002 & 31 Dec 2005 | PSEA | $200 | May 2022 |

| Notes: (1) Each Singaporean child will receive a one-off top-up to the relevant account, depending on his/her age and/or academic level. (2) Children born on 1 January 2016 who have started primary school in 2022 will receive the top-up in their Edusave accounts. (3) Those who are 16 years old in 2022 and studying in Government-funded post-secondary institutions (Junior Colleges or Centralised Institute) will receive the top-up in their PSEA. (4) Those who are between 17 and 20 years old in 2022 and studying in secondary schools will receive the top-up in their Edusave accounts. (5) Children studying in Government-funded special education (SPED) schools will receive the top-up in their Edusave accounts, regardless of age. Other children with special needs will also receive the top-up in the relevant accounts based on age. | ||||

Source: MOF

Note that the top-up to the Edusave account is in addition to the annual Edusave contribution by the Government.

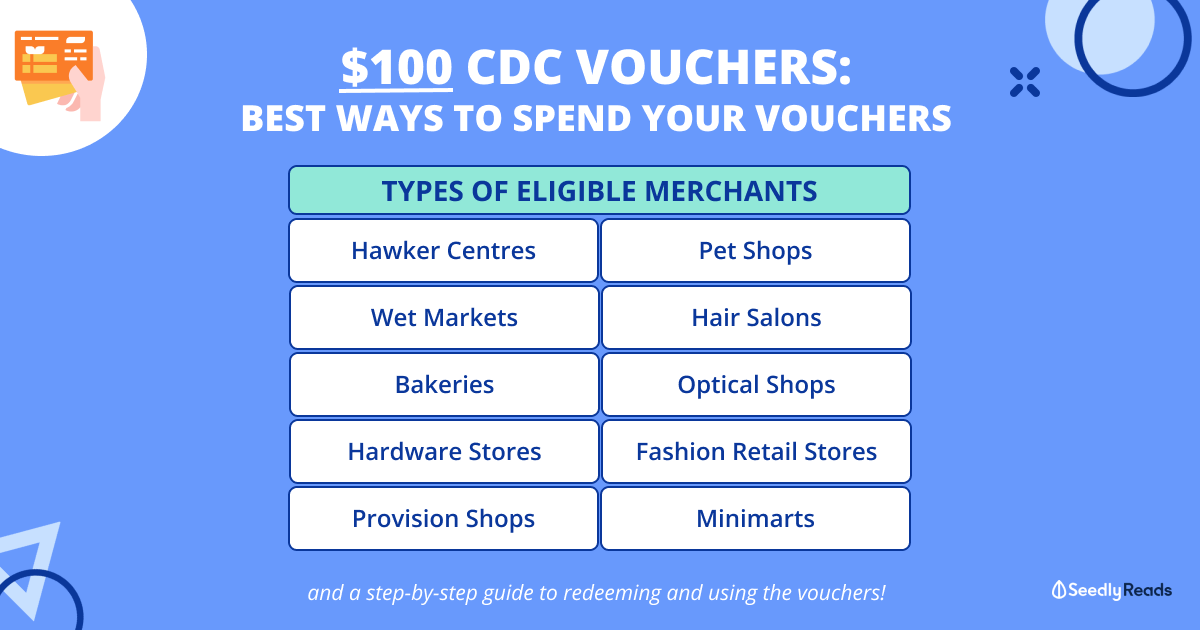

Household Support Package (HSP): $100 Community Development Council (CDC) Vouchers in 2022

The Government will partner with the Community Development Council (CDC) to give away another $100 worth of CDC vouchers to every household in Singapore in 2022.

These vouchers will help all Singaporean households cope with their daily expenses and can be used at participating heartland businesses like:

And supermarkets too.

But for now, information is still scarce. We will update this article with more details when the CDCs announce new information.

Budget 2022 Singapore Cash Payout Date: Assurance Package (AP) For GST

At Budget 2020, the Government announced a transitory $6 billion AP for GST to soften the blow of the planned GST hike for Singaporeans.

That’s not all.

About two years later, at Budget 2022, the Government announced that it would supplement an additional $640 million to beef up the AP.

With the new and improved AP, most Singaporean households will receive rebates that minimally cover five years’ worth of additional GST expenses.

The number is about doubled for lower-income households as they will receive rebates that minimally cover 10 years’ worth of additional GST expenses.

Assurance Package (AP): Cash Payouts

The first component of the AP is the AP Cash Payouts.

For this component, all Singaporeans aged 21 years and older will be receiving cash payouts ranging from $700 to $1,600, with the amount determined by their annual income and property ownership status.

These payouts will be made over five years from 2022 to 2026, starting in December 2022 and will benefit over 2.8 million adult Singaporeans.

Assurance Package (AP): Cash Payouts Amount and Timeline

| Singaporeans Aged 21 Years & Above in Reference Year | Payout Period | Owns 0 to 1 property | Owns >1 Property | ||

|---|---|---|---|---|---|

| Assessable Income (AI) | |||||

| AI≤$34,000 | $34,000< AI ≤$100,000 | AI>$100,000 | |||

| 2023 | Dec 2022 | $200 | $150 | $100 | $100 |

| 2024 | Dec 2023 | $400 | $250 | $200 | $200 |

| 2025 | Dec 2024 | $400 | $250 | $200 | $200 |

| 2026 | Dec 2025 | $400 | $250 | $100 | $100 |

| 2027 | Dec 2026 | $200 | $150 | $100 | $100 |

| Total | $1,600 | $1,050 | $700 | $700 | |

Assurance Package (AP): GST Voucher – Cash (Seniors’ Bonus)

In addition, the Government is giving cash payouts ranging from $600 to $900 for Singaporean seniors through the special GSTV – Cash (Seniors’ Bonus) component.

This payout will be made over three years, from 2023 to 2025, benefiting about 850,000 lower-income Singaporean seniors.

GST Voucher – Cash (Seniors’ Bonus) Payout Amounts and Timeline

| Property Ownership | Owns 0-1 property | |||

|---|---|---|---|---|

| Assessable Income (AI) | AI≤$34,000 | |||

| Annual Value (AV) of home | AV≤$13,000 | $13,000< AV ≤$21,000 | ||

| Age of Singaporean in Payout Year | 55 to 64 years | 65 years and above | 55 to 64 years | 65 years and above |

| 2023 | $250 | $300 | $200 | |

| 2024 | $250 | $300 | $200 | |

| 2025 | $250 | $300 | $200 | |

| Total | $750 | $900 | $600 | |

| Note: Individuals who own more than one property are not eligible for GSTV – Cash (Seniors’ Bonus). | ||||

Budget 2022 Assurance Package (AP): Utility Rebates

As mentioned above, households will receive Additional GST Voucher — U-Save rebates as part of the AP.

| HDB Flat Type | April 2022 | July 2022 | October 2022 | January 2023 | Total GSTV U-Save for FY2022 | ||||

|---|---|---|---|---|---|---|---|---|---|

| Regular U-Save | HSP U-Save | Regular U-Save | HSP U-Save | Regular U-Save | HSP U-Save | Regular U-Save | AP U-Save | ||

| 1- and 2-Room | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $95 | $760 |

| 3-Room | $85 | $85 | $85 | $85 | $85 | $85 | $85 | $85 | $680 |

| 4-Room | $75 | $75 | $75 | $75 | $75 | $75 | $75 | $75 | $600 |

| 5-Room | $65 | $65 | $65 | $65 | $65 | $65 | $65 | $65 | $520 |

| Executive / Multi-Generation | $55 | $55 | $55 | $55 | $55 | $55 | $55 | $55 | $440 |

| Notes: (1) Households whose members own more than one property are not eligible for GSTV – U-Save. (2) Additional rebates will be credited to eligible households at the same time as their regular GSTV – U-Save in the usual four quarters (April 2022, July 2022, October 2022, and January 2023). (3) The AP U-Save will be provided quarterly starting from January 2023 and ending in January 2026. | |||||||||

These additional AP GSTV – U-Save rebates are given out on top of the regular GSTV – U-Save rebates under the Permanent GSTV scheme and will be credited together with households’ regular GSTV – U-Save in the relevant months, as seen with the table below.

The first additional GSTV – U-Save rebates for 2023 will be credited in January 2023.

| HDB Flat Type | 1- & 2-room | 3-room | 4-room | 5-room | Executive/ Multi-Generation |

|---|---|---|---|---|---|

| 2023 | $95 | $85 | $75 | $65 | $55 |

| 2024 | $190 | $170 | $150 | $130 | $110 |

| 2025 | $190 | $170 | $150 | $130 | $110 |

| 2026 | $95 | $85 | $75 | $65 | $55 |

| Total | $570 | $510 | $450 | $390 | $330 |

| For reference: Regular GSTV – U-Save per year | $380 | $340 | $300 | $260 | $220 |

| Notes: (1) Households whose members own more than one property are not eligible for GSTV – U-Save. (2) Eligible households will receive their regular GSTV – U-Save over four quarters in April, July, October, and January. | |||||

Assurance Package (AP): MediSave Top-ups

That’s not all.

The Government is also giving out $450 in MediSave top-ups from 2023 to 2025 to the young and old.

More specifically, Singaporeans aged 20 and below and 55 years and above (~2 million Singaporeans) will benefit.

MediSave Top-ups Payout Amounts and Timeline

| Age of Singaporean in Payout Year | 20 years and below | 55 years and above |

|---|---|---|

| 2023 | $150 | |

| 2024 | $150 | |

| 2025 | $150 | |

| Total | $450 | |

Assurance Package (AP): CDC Vouchers 2022

Last but not least, the Government will partner with the CDCs to distribute an additional $400 worth of CDCs vouchers to all Singaporean households. These CDC vouchers are given out in addition to the $100 worth of CDC vouchers under the HSP.

The AP CDC vouchers will be given out in two tranches

2023: $200

2024: $200.

These vouchers will help all Singaporean households cope with their daily expenses and be used at participating heartland businesses and even supermarkets.

Top-ups to Citizens’ Consultative Committee ComCare Fund & Grants to Self-Help Groups

One more thing.

Over five years, the Government will top up $5 million to the Citizens’ Consultative Committee (CCC) ComCare Fund. If you are going through a tough time financially or know someone who is, you can approach your respective CCCs for assistance.

In addition, the Government will give another $12 million will over four years to Self-Help Groups like the Chinese Development Assistance Council (CDAC), Eurasian Association (EA), Yayasan MENDAKI, and the Singapore Indian Development Association (SINDA).